This year brought a lot of good news for those in passive management - 2015.

Passive is popular, that's for sure.

As Bloomberg's Eric Balchunas reported earlier, 2015 has seen a record $365 billion in net inflows to low-cost and passively managed index funds and exchange-traded funds (ETFs) at the same time that $147 billion has been withdrawn from active mutual funds. Unfortunately for Wall Street and active managers, Bank of America Merrill Lynch analysts led by Savita Subramanian suggest the trend will continue.

"In the past four years, passive investments have gone from one-fifth of long-only assets under management to one-third today," the BofAML team said in a note. They added: "Passive funds still only make up about one-third of the U.S. large cap space, far from critical mass."

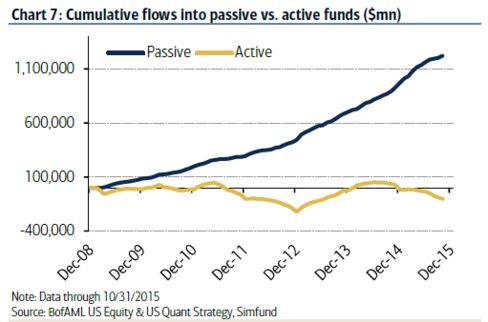

Here's a look at the flows into or out of active and passive funds since the end of 2008, with passive managers dominating.

Despite this rapid increase for inflows to passive investments, it still makes up a small share of total funds, as Subramanian said.

If active managers were delivering stellar returns, the trend might change. Alas, they haven't been.

According to BofAML, only 40 percent of active managers are beating the indices they are measured against. Those focusing on value plays have proven the most adept at beating benchmarks this year, while core managers have the lowest success rate, the bank said.

What could help turn this around?

According to the BofAML note, active managers tend to have a bias toward growth stocks, an aversion to foreign-exposed companies, and a preference for lesser-quality names, as measured by Standard & Poor's common-stock rankings. The funds will need to outperform in those areas to start having better luck against their benchmarks.

http://www.bloomberg.com/news/articles/2015-12-30/these-charts-show-the-astounding-rise-in-passive-management

No comments :

Post a Comment