- Researcher puts underemployment at 5% and 10% at zombie firms

- State-run coal and steel companies keep idle workers in limbo

Cracks are starting to show in China’s labor market as struggling industrial firms leave millions of workers in flux.

While official jobless numbers haven’t budged, the underemployment rate has jumped to more than 5 percent from near zero in 2010, according to Bai Peiwei, an economics professor at Xiamen University. Bai estimates the rate may be 10 percent in industries with excess capacity, such as unprofitable steel mills and coal mines that have slashed pay, reduced shifts and required unpaid leave.

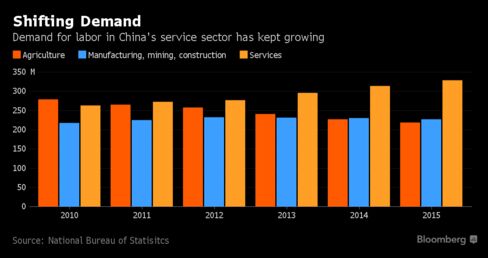

Many state-owned firms battling overcapacity favor putting workers in a holding pattern to avoid mass layoffs that risk fueling social unrest. While that helps airbrush the appearance of duress, it also slows the shift of workers to services jobs, where labor demand remains more solid in China’s shifting economy.

“Underemployment in overcapacity industries is a drag on the potential improvement of productivity in China, which will lead to a softening wage trend,” said Grace Ng, a senior China economist at JPMorgan Chase & Co. in Hong Kong. “It would exert pressure on private consumption demand and in turn affect the overall rebalancing of the economy."

Underemployment Tripled

Other projections indicate the employment situation is even worse. An indicator of unemployment and underemployment produced by London-based research firm Fathom Consulting has more than tripled since 2012 to 13.2 percent.

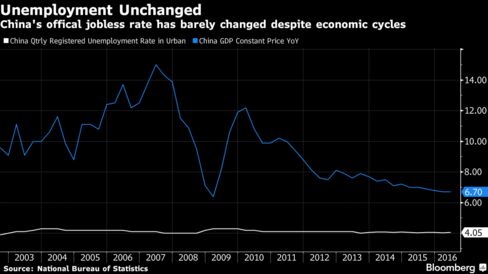

The official jobless rate isn’t much help for economists: it’s been virtually unchanged at about 4.1 percent since 2010 even as the economy slowed. The gauge only counts those who register for unemployment benefits in their home towns, which doesn’t take into account 277 million migrant workers. Total employment is 775 million, National Bureau of Statistics data show.

The NBS also compiles a newer survey-based jobless rate for big cities, which has been holding steady at about 5 percent, but that index isn’t updated on a regular basis. There’s no official underemployment rate.

With the newly-added labor force now in decline as the population ages, workers should become more scarce during the boom of the labor-intensive services sector. That suggests economic slowdown is the main culprit of labor under-utilization, said Fielding Chen, an economist at Bloomberg Intelligence in Hong Kong.

Bai bases his estimate on average labor activity and worker productivity. From 2004 to 2008, underemployment was effectively near zero following rapid productivity gains from China’s 2001 admission to the World Trade Organization and state-owned industry reforms.

Global Rates

Bai’s rate is lower than numbers for other countries, which use varying methodologies. The U.S. rate known as U-6 is 9.7 percent, down from a record 17.1 in 2009. Australia’s underemployed ratio is 8.7 percent. Mexico’s underemployment rate is 7.68 percent.

Conflicting objectives complicate China labor market dynamics. Even as President Xi Jinping and other top leaders pledge to reduce overcapacity, other official policies prevent widespread firings, in turn letting unprofitable "zombie companies" lock up broad swaths of the labor force by keeping them in limbo with shorter shifts and less pay.

In the heart of coal country, Shanxi Luan Mining Group Co. has said it put some workers on leave to alleviate pressure from downward prices and save money on wages. In Liaoning province, Angang Steel Co. has slashed some salaries by half as it aims to cut total pay by 10 percent this year and ordered early retirement for 3,600 workers, China Youth Daily reported in June.

“Underemployment is especially rampant at state-owned companies,” said Zeng Xiangquan, a professor of labor and human resources at Renmin University in Beijing. "The government tends to overprotect them." That keeps laid-off workers from getting retrained and hired into new jobs in more thriving sectors like services or high-end manufacturing, Zeng said.

Zombie Companies

Zombies make up about 7.5 percent of industrial businesses, which are mostly state-owned enterprises in the northeast rust belt and the less-developed western regions, the official Xinhua News Agency reported in July, citing Renmin economics professor Nie Huihua.

"There’s no quick fix," said Fathom economist Laura Eaton. "In the short term, to reduce the problem of underemployment in China, the government should allow those ‘zombie companies’ with low productivity growth and excess capacity to default or shut down."

If policy makers act swiftly, history shows it’s possible for them to tighten that unwanted slack back to where it used to be, said Bai, who has tracked China’s underemployment back to the beginning of the reform and opening up in 1978.

Bai’s research shows that underemployment peaked in 1983, 1990 and 2002, but fell sharply after each episode. China began SOE overhauls and extended economic reforms from rural areas to cities in 1984, pushed further overhauls in 1992, and enjoyed an export-led lift off in the early 2000s after WTO entry.

More fiscal policy support for the economy and funding to help fired miners and steelworkers get new skills would be good steps toward a solution, JPMorgan’s Ng said.

If the other accompanying structural changes let the stronger services sector and healthier new industries tap idle productivity, Bai said, underemployment could decline once again.

— With assistance by Xiaoqing Pi, and Miao Han

No comments :

Post a Comment